German Gov. Now Raiding & Seizing Goods From Chinese Amazon Dealers.

The tax office in Neukölln has confiscated the stocks and balances of Chinese traders on Amazon.de and blocked their merchant accounts on the platform. Earlier, Amazon Germany had contacted the relevant dealers and suggested that the German tax authorities could act against VAT fraud, reported Chinese media. The report apparently caused panic among Chinese traders. It should come to mutual denunciations, so the tax affair could draw more circles.

In the Berlin tax office should actually register all online retailers who sell goods from China to Germany. But obviously only a few do. On Amazon’s German marketplace and Ebay, up to 6000 Chinese vendors are said to be frolicking, blogger Mark Steier calculated, formerly on Ebay itself as a “Platinum Powerseller” active. In fact, just 432 online retailers based in the People’s Republic and Hong Kong should be registered for VAT in Neukölln. That does not mean that they pay all taxes. More than 90Accordingly, percent of providers can not provide a German VAT number. Their sales flow so far safe tax-free on the Treasury. In Neukölln, nine tax officials are trying to find sinners in detective work.

The state escapes through VAT fraud estimated revenue of up to one billion euros per year. Ascending trend. Germans are buying more and more goods online; Online shopping at Christmas broke all records. Most of them were handled through Amazon.de. The group has a monopoly on the Internet and knows about the massive sales tax fraud.

But he cares little about it. As early as 2016 , Amazon Germany was targeted by the investigators. At that time, the investigators searched several logistics centers and the Germany headquarters in Munich. There was a suspicion of sales tax fraud, but not by Amazon itself. The Group avoids the possibility of paying taxes in Germany, but sales tax fraud is not accused him, but only some marketplace dealers. Therefore, Amazon is suspected of at least tolerating the illegal practice.

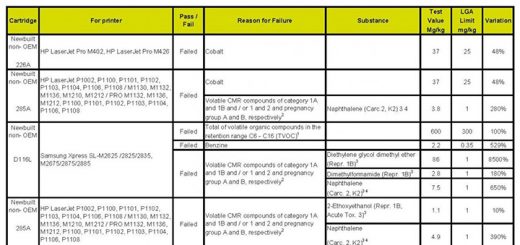

A tax threshold is used

The company rejects the charge. The mail order company argues that the traders would have to pay the sales tax themselves. Some lawyers see in the worst case, aid to tax evasion. But that does not appeal to Amazon. Despite the raid one and a half years ago, Amazon has not changed its lax approach. The US company argues that dealers are “required to be independent entities to fulfill their tax obligations”. Amazon has no authority to review their tax matters, says a spokesman. The Group only reacts when “we receive information that a seller is failing to fulfill his tax obligations”. That means: Amazon acts only if the investigators have uncovered the fraud anyway. And even then, the corporation applies only “processes” to counter the fraud, but does not check every single case. That would be much more complex and the group probably too expensive.

The state demands the legislature. “Platform operators must be in the fiscal liability,” says the head of the German tax union, Thomas Eigenthaler. The country finance ministers want to propose a law this spring, which is intended to take portals like Amazon.de in the liability; earlier than the EU plans so far. In Europe, the import of goods with a value of up to 22 € is currently VAT exempt. This exemption limit is often exploited by declaring a lower value. The EU finance ministers therefore decided to set the 2021 thresholdto tilt. In addition, the platform operator should be treated as a seller of goods in sales tax. This is the duty of the platform for the correct payment of the tax. Currently, authorities often can not hold anyone responsible for the payment. The traders are usually not available in non-EU countries. From the point of view of the German Trade Association (HDE), the new rules provide more international fairness. HDE Chief Executive Stefan Genth says: “Anyone who sells goods in this country must also pay the correct sales tax, which is the only way to ensure fair competition in the marketplace.” The honest taxpayers among the companies must not be the losers. ”